19+ rhode island paycheck calculator

Simply enter their federal and state W-4 information. The state income tax rate in Rhode Island is progressive and ranges from 375 to 599 while federal income tax rates range from 10 to 37 depending on your income.

![]()

Free Rhode Island Payroll Calculator 2022 Ri Tax Rates Onpay

All you need to do is enter wages earned and W-4 allowances for each of your employees.

. Supports hourly salary income and multiple pay frequencies. Rhode Island Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Rhode Island.

Calculate your Rhode Island net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Rhode Island. Total annual income Income tax liability Payroll tax liability Pre-tax deductions Post-tax deductions Withholdings Your paycheck Thats the six steps to go. Well do the math for youall you need to do is.

Rhode Island Income Tax Calculator 2021 If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081. The following steps allow you to calculate your salary after tax in Rhode Island after deducting Medicare Social Security Federal Income Tax and Rhode Island State Income tax. We designed a handy payroll calculator to ease your payroll tax burden.

Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Rhode Island. Use ADPs Rhode Island Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. Calculate your payroll tax liability Net income Payroll tax rate Payroll tax liability minus any tax liability deductions withholdings Net income Income tax liability. Average value over interval calculator.

Your average tax rate is 1198 and your marginal. Just enter the wages tax withholdings and other information required. Luteal phase length calculator.

So Rhode Island January 2021 By Providence Media Issuu

Paycheck Calculator Take Home Pay Calculator

Real Estate Agents In Navi Mumbai Property Dealers Brokers

Rhode Island Salary Paycheck Calculator Gusto

Free Payroll Tax Paycheck Calculator Youtube

Free Paycheck Calculator Hourly Salary Usa Dremployee

Pdf Evaluating The Generalizability Of The Covid States Survey A Large Scale Non Probability Survey

Here S How Much Money You Take Home From A 75 000 Salary

5 Best Banks For Students Of 2021 2022 Money

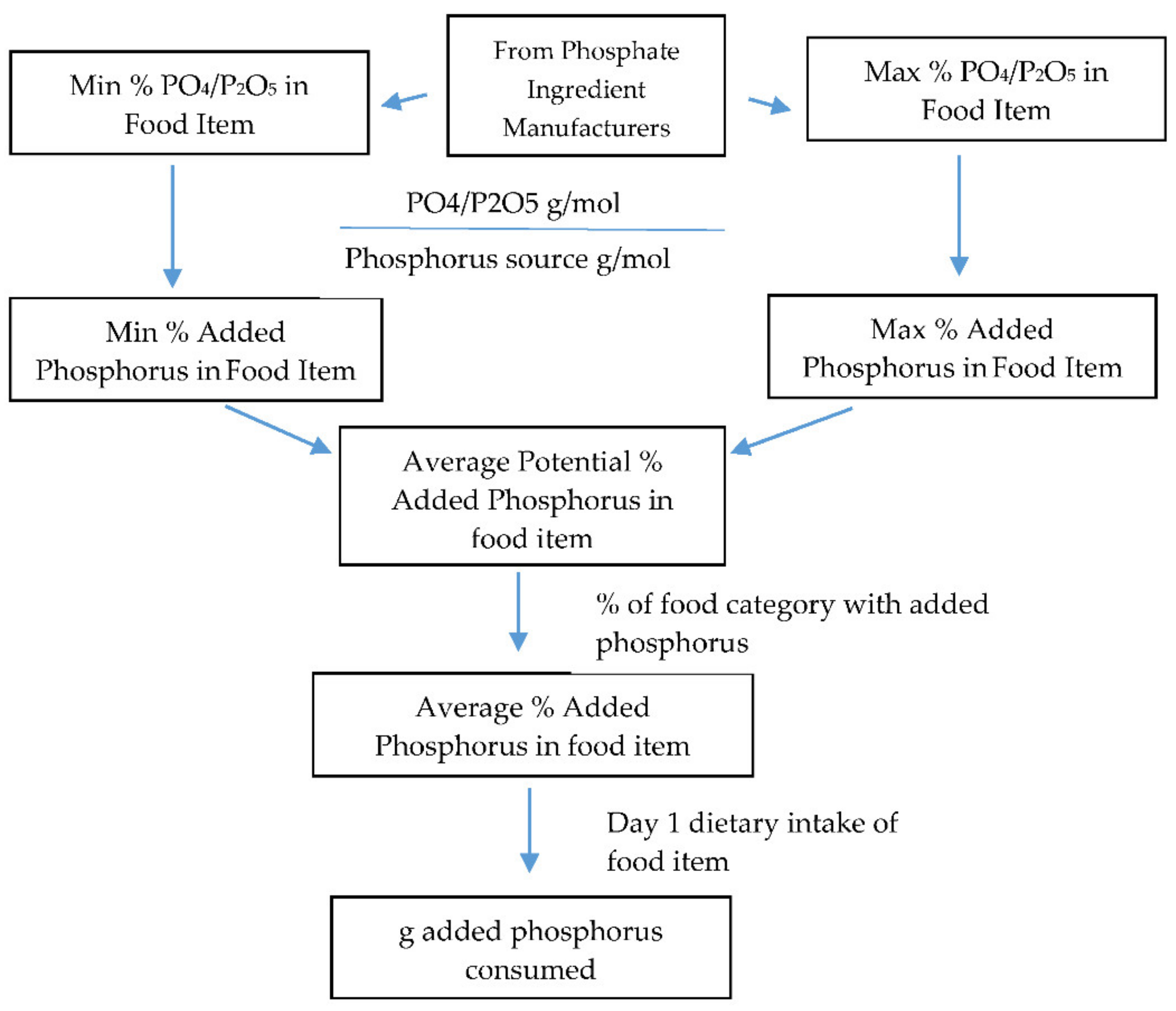

Nutrients Free Full Text Trends In Total Added And Natural Phosphorus Intake In Adult Americans Nhanes 1988 1994 To Nhanes 2015 2016 Html

Paycheck Calculator Template Download Printable Pdf Templateroller

Pdf Evaluating The Generalizability Of The Covid States Survey A Large Scale Non Probability Survey

How To Become A 1m Year Real Estate Agent Upflip

Here S How Much Money You Take Home From A 75 000 Salary

Allsup Reviews What Is It Like To Work At Allsup Glassdoor

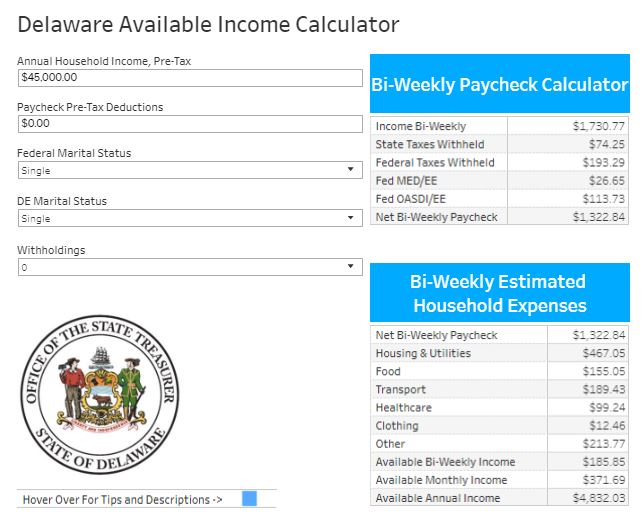

Delaware Available Income Calculator State Treasurer Colleen C Davis State Of Delaware

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live Markets Insider